How To Be Smarter With Money: 8 Simple Secrets

.

***

Before we commence with the festivities, I wanted to thank everyone for helping my first book become a Wall Street Journal bestseller. To check it out, click here.

***

Everyone wants to know what the next great investment is. But that’s the wrong question.

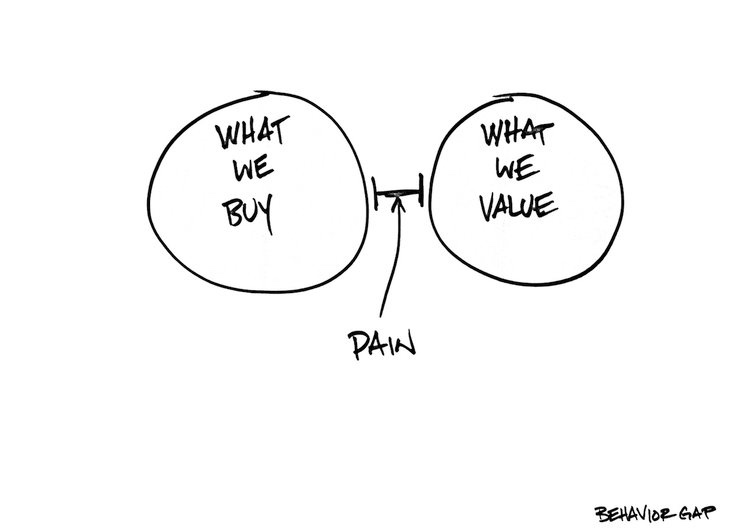

If you want to make money over the long haul, picking investments isn’t the real problem. When studies compare how well investments perform to how well investors perform there’s always a gap. Investors almost invariably do worse than the investments do.

From The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money:

The studies typically compare investors’ actual returns in stock funds to the average returns of the funds themselves. Just to be clear, they’re trying to compare the returns investors get to the returns investments get. Is there really a difference? Oh, you bet there is. Typically, the studies find that the returns investors have earned over time are much lower than the returns of the average investment.

So what’s going on? The problem is our behavior. We do dumb things like buying high and selling low or choosing a stock that delivers a solid return — while paying twice that in interest on credit card debt. And if we continue to do dumb things it doesn’t matter what the investment is; we’ll screw it up.

A lot of financial advice is straightforward and simple (“earn more, spend less.”) But then again so is most dieting advice (“eat less, exercise more”) and we just don’t do it. It’s simple — but not easy.

So who can lead us out of this trap? Carl Richards writes about personal finance for the New York Times and is the bestselling author of The Behavior Gap and The One-Page Financial Plan.

He puts it quite simply: “Financial success is more about behavior than it is about skill.”

Let’s get to it…

Reminder: You Cannot Predict The Future

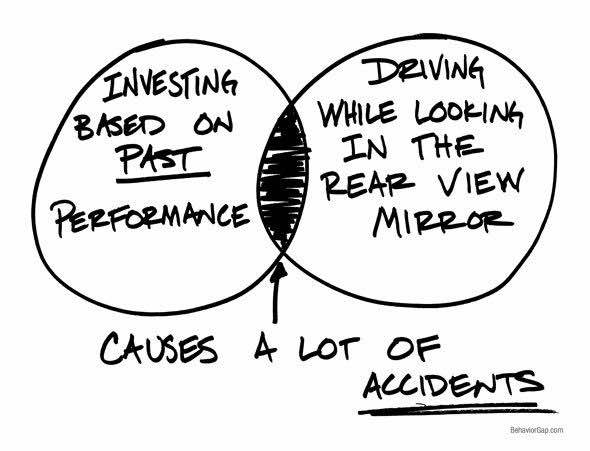

There is no “perfect” investment. Timing is always an issue. People said internet stocks just keep going up — and then 2000 happened. Buying a home was a surefire bet — and then 2008 rolled around.

From The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money:

Trying to pick a stock’s future growth path based on past growth is like trying to guess if a coin will come up heads or tails when you know that the last toss was a heads. The previous toss tells you nothing.

Some people will argue: “But Apple climbed more than 4,000 percent from the end of 2000 to the end of 2010!” Sure, but do you think it’s going to keep doing that forever? Of course not. So we’re back to predicting the future. And, sadly, your Magic 8 Ball keeps saying, “Reply hazy, try again.”

This shouldn’t paralyze you. You’re going to invest your money somewhere. But you want to base your decisions on sound principles — not assumed outcomes that are always uncertain.

(To learn more about the science of a successful life, check out my bestselling book here.)

To really improve your finances over the long haul, you need a plan. No, it doesn’t have to be some 200-page behemoth you will never ever look at and doesn’t require you to analyze every cable and phone bill you received over the past 15 years.

In fact, the plan can fit on an index card…

Ask “What Does Money Mean To Me?”

Financial planning seems so overwhelming that our first response is to throw up our arms and beg any expert to “just tell me what to do.” But that doesn’t work.

Carl asked top financial managers to advise him as if he was a new client — but wouldn’t let them ask him any questions. They just had to just make blind recommendations. And exactly zero of them could responsibly do it.

Because financial decisions are often life decisions. And all of our lives — and our life goals — are different.

From The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money:

Financial decisions almost always are life decisions. Before you decide on your financial goals, you need to choose your life goals. When you link financial decisions to life decisions, you encounter a whole different set of challenges. Each person’s financial situation becomes unique, because their goals are unique. It’s no longer about abstractions like a secure retirement or a college education—it’s about your vision of retirement, and your child’s education. What brings you happiness may not bring your neighbor happiness—and a canned plan won’t work for either one of you.

And so the first — and most important — question to ask yourself is, “What does money mean to me?” (Yeah, I know, you didn’t expect financial planning to sound like you’re talking to a therapist.)

Does money mean security? Opportunity? Freedom? Something else? Once you have that answer keep digging. You want to get a vision of what your real goals are along with an idea of your time horizons, risk tolerance and what kind of changes you’re willing to make.

Your plan doesn’t need to be crystal clear and it can change. But you’ll need it as a North Star so that you don’t go chasing every “next big thing” you read about in the newspaper or the hot stock Uncle Jack mentions at the holiday dinner table.

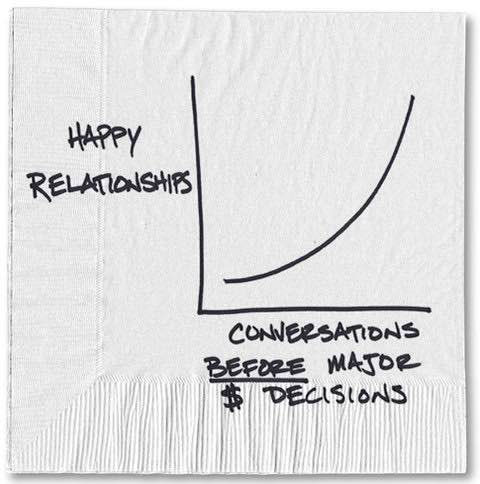

If you have a spouse or partner you’ll want to have this discussion together because their North Star might be different than yours.

Once you have an idea what money means to you, you want to be more concrete about your goals. Specify three big ones. Do you want to be all set for retirement 30 years from now? Or to put your kids through college in 15? Do you want to buy a house in 5 years? Or travel more in 2?

Carl says the process is about realizing where you want to go, where you are now and then narrowing the gap. Because the primary question when evaluating any investment is, “Will this help me reach my goals?”

(To learn more research backed tips on how to save money, click here.)

And now that you know what’s important, we can talk about behavior. And behavior often comes down to feelings.

Feelings can be the most powerful things in our lives. Feelings can make memories that last. But if you’re not careful…

Feelings Can Be Very Expensive

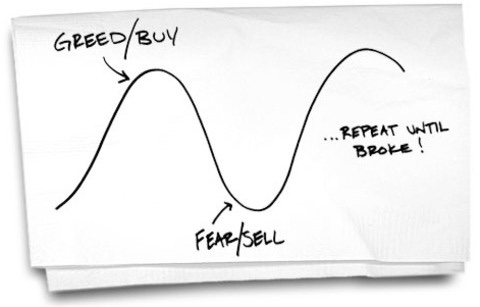

We buy high and sell low because we feel safe when we follow the pack. We hold on to our employer’s stock even when it’s not aligned with our goals because we feel loyal.

And we trade stocks unnecessarily because it feels, well… fun. There’s a word for that: gambling.

What can we all agree on about gambling? It’s fun, exciting… and something you would never recommend anyone use as the basis for their retirement or their kids’ education.

Investing is not entertainment. Base your decisions on goals and principles, not on your feelings about what’s going to happen. Don’t “play” the stock market; that’s how you get played.

(To learn the two-word morning ritual that will make you happy all day, click here.)

But right now you may not have much cash to even think about investing. So what’s a dead-simple way to start spending less?

Use The 72-Hour Test

Obviously, you want to do what every financial advice column since the dawn of time recommends: track your spending. It’s boring — but as we just learned, boring is good. Spending less is important — but it’s not easy. How can we make it a little easier?

Luckily, Jeff Bezos created a wonderful feature to help you control your spending. It’s called your Amazon Shopping Cart. Face it, very few of the things you buy online need to be purchased immediately. From now on, anything you would have bought with one-click goes in your Shopping Cart for a mandatory 72-hour holding pattern.

After three days, when the gimme-gimme-gimme emotions have died down, objectively ask if this thing is more important than getting closer to the goals on your one-page financial plan.

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

When I return to the site, I rarely feel as strongly about buying what’s in my cart. So I delete those items, and in the process save myself a lot of money and the need to find more space. The nice thing about the 72-Hour Test is that very few things must be bought right now. The extra time provides a cushion: we’re not saying “no”; we’re simply not giving in to our urge for instant gratification.

(To learn 5 secrets from neuroscience that will increase your attention span, click here.)

So you’re spending less. Cool. But how do you actually start saving — and without exerting any self-control?

Automate Good Behavior

The easiest way to not make dumb decisions is to not let yourself actually make the decisions. Most, if not all, online financial sites let you automate transactions.

Let your Dr. Jekyll set up transfers to savings, payments of bills, and anything else important so your Mr. Hyde doesn’t go on a spending spree.

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

Instead of forcing yourself to make these decisions again and again, make them automatic so your good intentions can turn into good behavior. You can automate your savings and your 401(k) allocations and make sure they’re automatically rebalanced, and I also suggest automating certain set payments, like mortgages or car loans… The point is: by making these decisions automatic, the temptation to cheat will decrease.

(To learn 3 secrets from neuroscience that will help you quit bad habits without willpower, click here.)

You’re spending a little less and painlessly saving more. Now how do you properly evaluate those investments that were purchased long before you read that insanely helpful blog post on personal finance?

Use The Overnight Test

You’re now a lot more clear on your financial goals. But you weren’t before when you purchased the investments you’re currently holding. How do you get everything in alignment?

From The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money:

Ask yourself what you would do if someone came in and sold all of your investments overnight. The next morning you wake up and you’re left with 100 percent cash in your account. Here’s the test: you can repurchase the same investments at no cost. Would you build the same portfolio? If not, what changes would you make? Why aren’t you making them now?

(To learn the secret to never being frustrated again, click here.)

Your current investments are now aligned with your goals. So how do you start making new, good investments?

Know The Fundamental Rules Of Investing

Number 1: Pay down debt.

Number 2: Are you sure you can’t pay down more debt?

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

If you’re holding on to debt with high interest rates, paying those debts down trumps just about any other financial investment you can make… People who understand interest earn it. People who don’t pay it.

Think about it: paying off debt has a guaranteed return. Literally, zero risk. You don’t pay interest on what you don’t owe. And debt always stands in the way of pursuing those goals you just defined.

Number 3: make sure to diversify. By not putting all your eggs in one basket you reduce risk and often increase returns.

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

The magic of diversification is that you can take two individual investments, which when viewed in isolation are individually risky, and blend them in a portfolio. Doing so creates an investment that’s actually less risky than the individual components and often comes with a greater return. In finance, this is as close as we get to a free lunch.

In finance, “unsystematic risk” is betting on a particular stock, sector or industry. This requires knowing the future. We want to eliminate unsystematic risk. We want to focus on “systematic risk.” That means betting on the system as a whole.

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

What you want instead is to take on “systematic risk”—this means you’re invested in the concept of capitalism as a whole. It’s based on the assumption that, despite the up-and-down nature of the market (and how terrifying the “downs” are), over long periods of time, it will continue to grow. Therefore, you want to own hundreds of stocks across the market; sure, some of the companies you own will fail, but it won’t really affect you because you spread your risk across a whole bunch.

This means mutual funds are usually better than individual stocks. But what’s the problem with mutual funds? Fees. You want to keep costs as low as possible.

Tons of studies have tried to tease out what makes one mutual fund better than another. What was the only predictive variable they found that determined which investors made more money?

From The One-Page Financial Plan: A Simple Way to Be Smart About Your Money:

It turns out that there’s not a single variable that will help you identify how a mutual fund will perform—except for one. Cost. Which really just boils down to simple math: the more you pay for your investments, the less money you’ll end up keeping.

Beyond that, always review your one-page financial plan and ask if the investment helps you meet your goals. It does? That’s exciting! But we now know not to trust excitement. Sounds too much like fun and fun is dangerous when investing.

So have a friend or family member ask you three questions to make sure you’re not making a mistake:

- If I make this change and I am right, what impact will it have on my life?

- What impact will it have if I’m wrong?

- Have I been wrong before?

If the answers are “little”, “horrendous” and “frequently” you may want to consider a safer investment like, say, Russian roulette.

(To see the schedule that very successful people follow every day, click here.)

The final piece of advice is something you have always wished someone would tell you is the path to riches…

Be Ignorant And Lazy

A huge mistake people make is reading too much short-term financial news that leaves them itchy to buy, sell, or otherwise gamble. Say it with me now: you can’t predict the future. And neither can the experts.

But they need to make predictions every day nonetheless. This has the result of helping them keep their jobs and helping you lose money. The press doesn’t write stories about people who saved their pennies, paid off their credit cards and made safe, boring investments over thirty years. (Yawn.)

So do your homework in advance and then ignore the news. Daily updates just make you anxious and anxiety rarely leads to smart money decisions. Only pay attention to what really matters to your goals and what you can control. As Carl likes to say, “Focus on your personal economy and stop worrying about the global one.”

Some people will push back: “But what about Black Swans! If people had paid attention we could have avoided the 2008 crisis!” Well, they’ve done research on the experts who correctly predict extreme shifts. And guess what?

From The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money:

The guys who occasionally nail a very dramatic forecast are actually less reliable than their more middle-of-the-road colleagues. Keohane cites a 2010 study by Oxford economist Jerker Denrell and New York University’s Christina Fang, who dug through data from the article “Survey of Economic Forecasts” in The Wall Street Journal. Denrell and Fang concluded that economists who correctly call the most unexpected events have worse long-term records than the rest of the pack.

So set aside regular time to diligently plan — and then be lazy. At first it may seem terrifying to ignore the news but think of the time you’ll save not tracking the market, not trading and not listening to Jim Cramer shout.

(To learn the 4 secrets to reading body language like an expert, click here.)

Okay, we’ve covered a lot. Let’s round it all up…

Sum Up

This is how to be smarter with money:

- Reminder – You Cannot Predict The Future: Timing the market isn’t investing; it’s gambling. And how would you react if I said I planned on funding my retirement through gambling?

- Ask, “What Does Money Mean To Me?”: Make a simple plan and then make sure your investments serve it.

- Feelings Can Be Very Expensive: Investing is boring. And make sure it stays that way. Don’t “play” the market. That’s how you get played.

- Use the 72-Hour Test: Very few things need to be bought immediately. Let them sit in your shopping cart for 3 days to prevent impulse buys. (The only exception is my book, which should be purchased immediately and in bulk.)

- Automate Good Behavior: Until our robot overlords arrive, make sure to take advantage of our robot underlings. The best way to be consistent about good behavior is to automate it.

- Use The Overnight Test: If all your investments got sold, which ones would you actually re-buy? And why doesn’t your portfolio look like that now?

- Know The Fundamental Rules of Investing: Pay off debt. Diversify. Keep costs low. Eliminate unsystematic risk.

- Be Ignorant And Lazy: “TMI” is a bad idea with people you’ve just met and with investing. If your money is already hard at work, why interrupt it?

Simple, but not easy. So plan, automate and be lazy so you can get out of your own way.

It’s not gambling, but that doesn’t mean it’s not rewarding.

Being smart with money is short-term boring, but long-term sexy.

Join over 320,000 readers. Get a free weekly update via email here.

Related posts:

New Neuroscience Reveals 4 Rituals That Will Make You Happy

New Harvard Research Reveals A Fun Way To Be More Successful

How To Get People To Like You: 7 Ways From An FBI Behavior Expert